Powerful crypto trading platform with fast matching engine, clean user interface and the most unique features. The crypto exchange is fully integrated into the ecosystem and linked to all other apps. Coins waiting in open orders still generate rewards.

The first exchange where you receive staking and interest rewards for coins sitting in open orders. Your coins keep working for you until the order is filled.

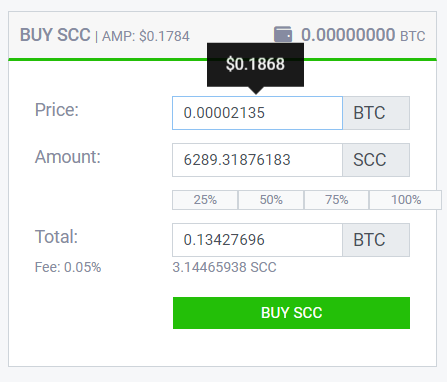

Pay fees only for trades that are actually executed, no fees when placing an order and no other hidden costs. You can further reduce the 0.2% fee down to 0.0% with our unique SCC masternode registration.

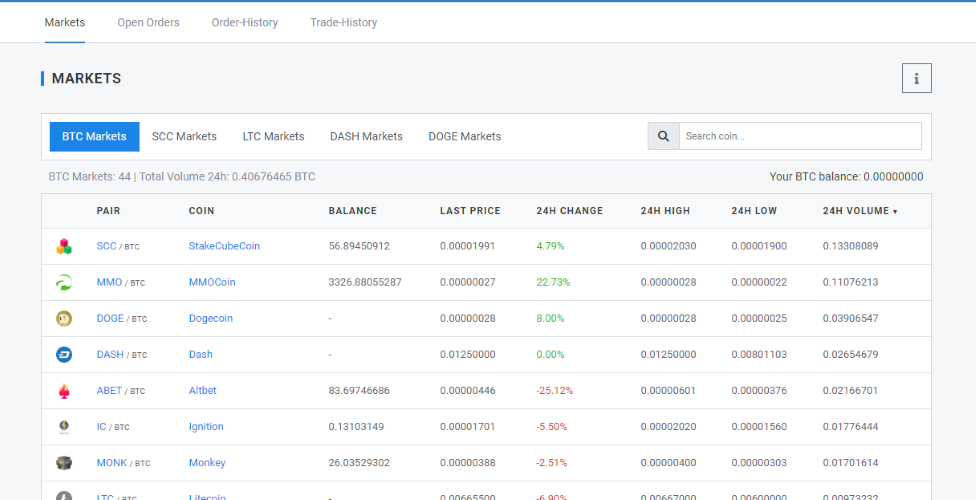

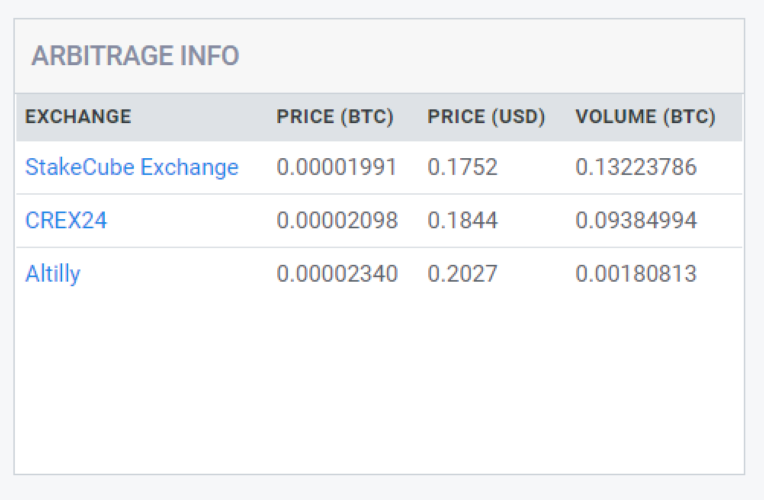

Buy and sell within constantly growing markets against BTC, SCC, USDT and BUSD. The unique arbitrage info shows you not only a reference, but also top trading opportunities between other exchanges.

With 250+ markets in total.

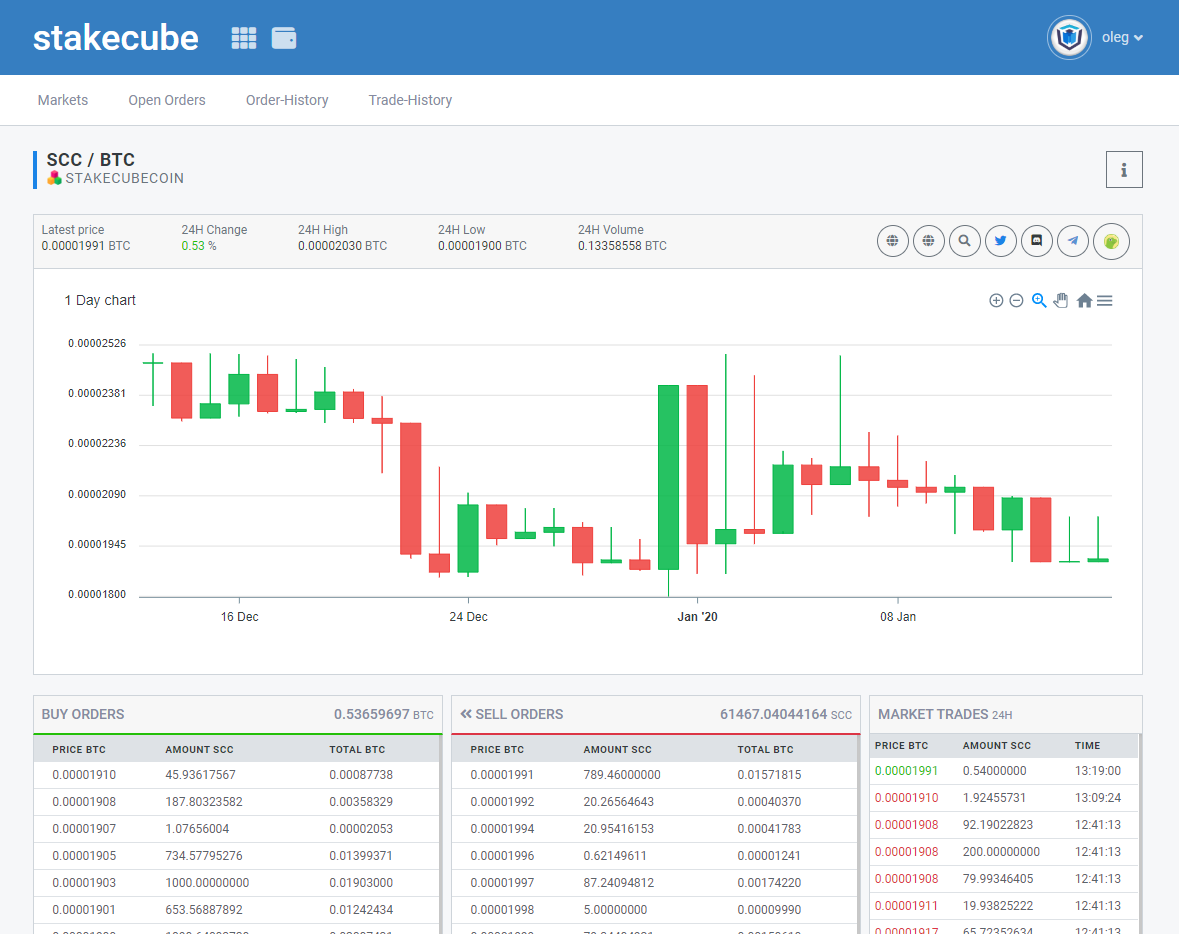

Get a quick overview about the market movements, volume and switch easily between base pairs.

Place orders, buy and sell coins in no time. Many little details facilitate the handling and show you all necessary information.

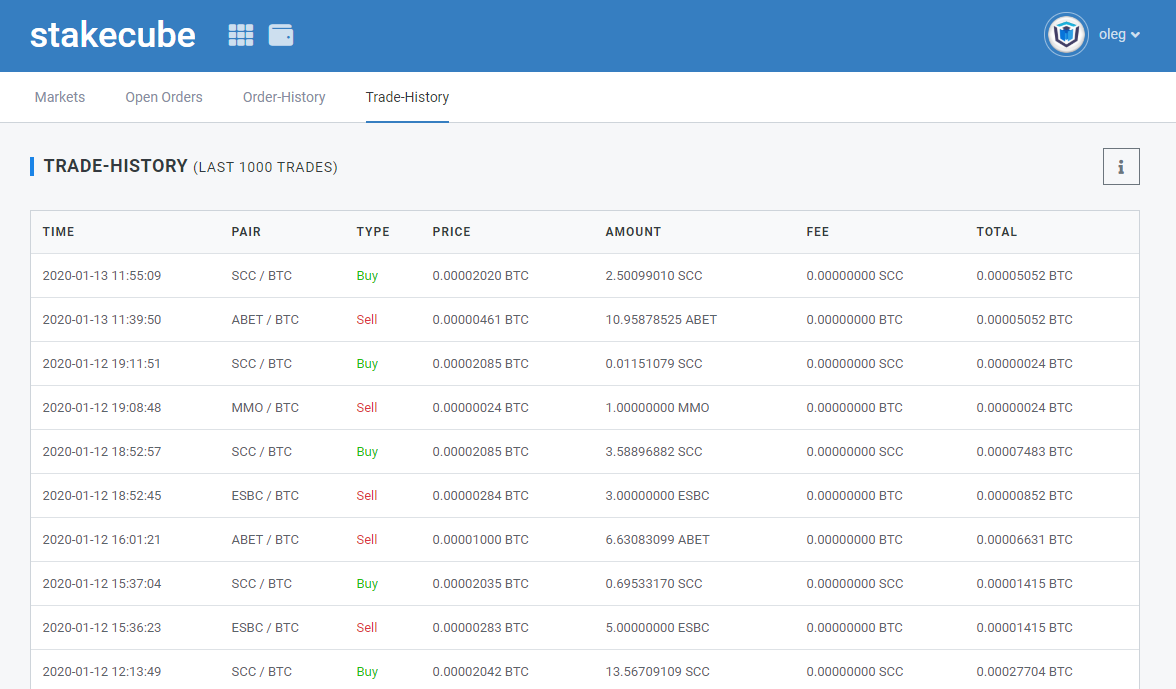

Manage and follow your orders and trades trough the different overviews.

Compare coin prices and take profit through great arbitrage possibilities. Every info you need in one place.

A Crypto Exchange is an online platform that offers trading of cryptocurrencies and other related services to its users. Some exchanges support trading of digital assets in exchange for fiat currencies while others only the exchange of one cryptocurrency into another. The possibility to deposit and withdraw fiat currencies is known as fiat on-ramp and off-ramp respectively. Exchanges that offer it generally require a process of user identity verification or KYC (know your client / know your customer). However, many purely Crypto to Crypto exchanges also enforce KYC in order to comply with local trading regulations and anti-money laundering policies.

Different exchanges support different cryptocurrencies, occasionally in exchange for a listing fee paid by the coin team; but also exchanges can choose to list coins that are popular and will bring traffic to their sites. Most platforms also charge trading fees on a per-trade basis, or have additional withdrawal and deposit fees that help cover costs and maintain the business. An exchange may also offer other services related to specific cryptocurrencies, like staking or masternodes, when the coins support them.

Exchanges provide liquidity and bring exposure to cryptocurrencies, which is the reason projects seek to be listed on them, particularly on the largest ones. Because of this, listing fees for these exchanges can be prohibitively expensive, occasionally in the millions of dollars. This is an entry barrier for newer easily overlooked projects, and confer a strong competitive advantage to those that accessed the most liquid exchanges first. Moreover, thanks to deposits from their users, exchanges can control huge shares of the coin supply of some projects. Exchanges are thus very powerful entities in the Crypto space, and bring up questions regarding true decentralization as they are in many aspects effectively central authorities. Because of their role as custodians of user funds, and their big market share, exchange hacks and subsequent closures have caused huge losses to both individuals and coin projects involved. This is why exchanges must be extremely thorough implementing safety measures to safeguard assets deposited by their users. Individuals might also have their information stolen or their personal accounts broken into. To prevent loss of user funds, exchanges should also have in place a 2FA (2 factor authentication) system for log in and withdrawal. These systems allow users to set up verification using a phone app like Google Authenticator, or to limit account access to the specific ip addresses they want to use, having to verify them via email.

A special case of cryptocurrency exchanges are Decentralized Exchanges, known as DEX for short. These exchanges have no central authority; trades are made peer-to-peer, without the need to deposit or move coins to the platform first. This allows full custody of the assets and complete control over the whole process to the parties involved. They also make it significantly cheaper and easier for blockchain projects to get a listing and access liquidity. However since there is no central authority, decentralized exchanges cannot halt trading in case of a hack, and cannot support any kind of KYC process or limit access to specific individuals.

StakeCube StakeCube |

Binance Binance |

Bitfinex Bitfinex |

Kraken Kraken |

|

|---|---|---|---|---|

| Supported coins | 100+ | 180+ | 140+ | 30+ |

| Markets | 250+ | 580+ | 380+ | 120+ |

| Trading fee | 0.2% - 0.00% | 0.1% - 0.075% | 0.1% - 0.2% | 0.1% - 0.26% |

| Withdraw fee | ||||

| Rewards for open orders | ||||

| Margin Trading | ||||

| Fiat transactions | ||||

| Min. trade amount |